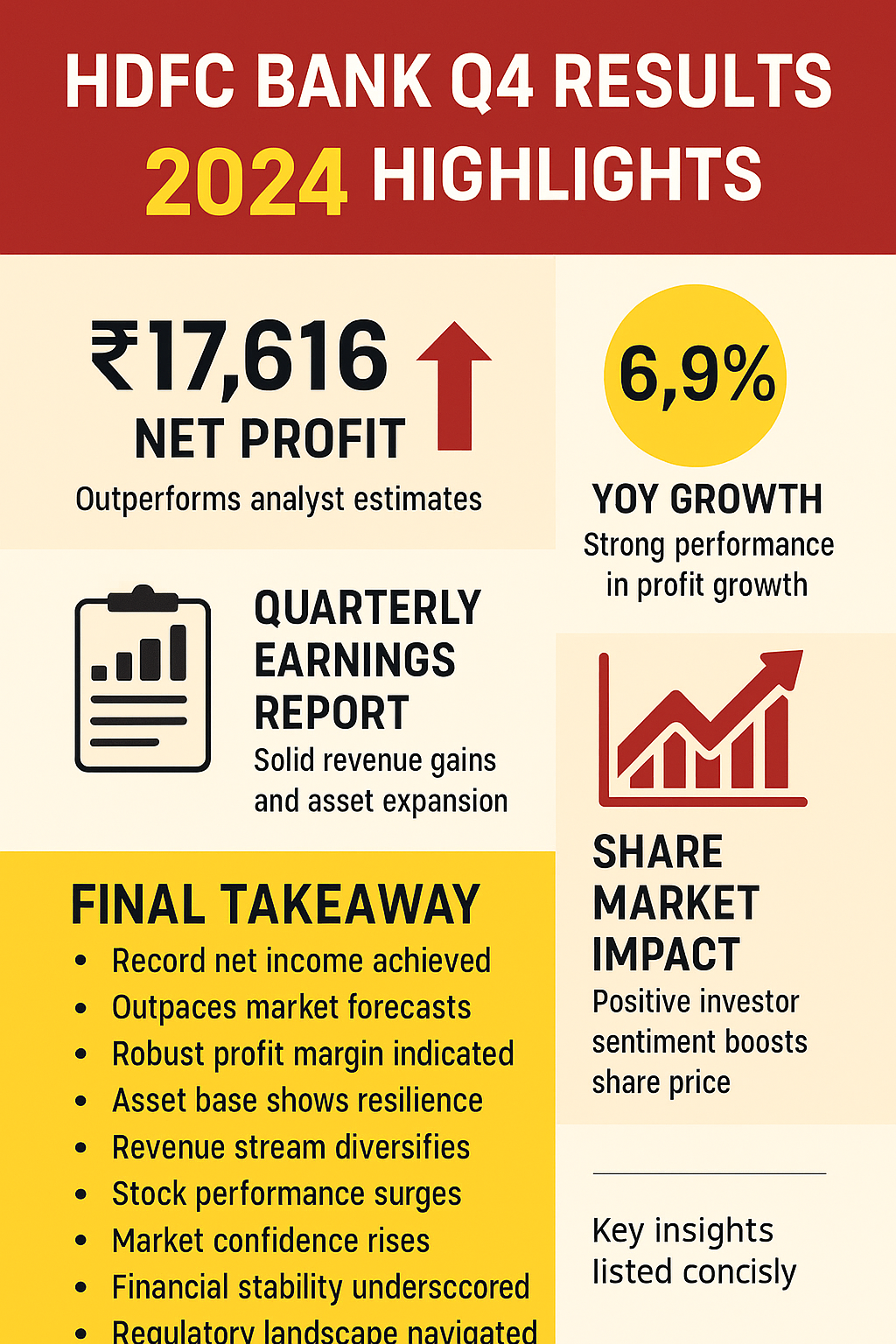

HDFC Bank Q4 Results 2024 highlights a ₹17,616 Cr net profit, beating estimates with 6.9% YoY growth. Explore full earnings report and share market impact.

HDFC Bank Q4 Results 2024: Strong Profit Surge Shakes Indian Banking Sector

The HDFC Bank Q4 Results 2024 have arrived with a major impact on India’s financial landscape. HDFC Bank, the country’s largest private sector lender, has once again showcased its market dominance by reporting a solid 6.9% year-on-year (YoY) increase in net profit for the fourth quarter of FY24.

HDFC Bank Q4 Results 2024: What You Need to Know

The earnings report revealed a net profit of Rs 17,616 crore, surpassing analysts’ expectations and underlining the bank’s strong financial performance. Starting with the focus keyword HDFC Bank Q4 Results, this article explores the key highlights, market reactions, and the broader implications on the Indian economy. This quarter’s financial results highlight not only the bank’s operational efficiency but also reflect growing consumer and investor confidence.

In an era of rising competition in the private banking sector, HDFC Bank Q4 Results stand as a testament to the institution’s consistent performance and robust growth strategy. With improved net interest margins, strong loan book expansion, and better asset quality, HDFC Bank continues to outperform market benchmarks. This comprehensive analysis delves into each major component of the bank’s quarterly results.

Read More

HDFC Bank Q4 Results 2024 Highlights

HDFC Bank’s Q4 FY24 financial summary reflects impressive growth. The total income rose by over 18% YoY, while the net interest income increased by 14.9%. The gross non-performing asset (NPA) ratio remained stable at 1.24%, indicating strong asset quality.

Moreover, operating profit for the quarter stood at Rs 23,351 crore, with a 15.3% growth from the previous year. The results indicate a stable banking operation supported by a disciplined risk management framework.

The HDFC Bank Q4 Results 2024 highlights include:

- Net Profit: Rs 17,616 crore (up 6.9% YoY)

- Total Income: Rs 75,837 crore (up 18.3%)

- Net Interest Income: Rs 29,080 crore (up 14.9%)

- Operating Profit: Rs 23,351 crore

- Gross NPA: 1.24%

HDFC Bank Quarterly Earnings Report

The HDFC Bank quarterly earnings report provides a deep insight into the bank’s financial health and strategic direction. The bank has demonstrated excellent execution in its retail and corporate banking services, bolstering its market presence.

Analysts believe the bank’s merger with HDFC Ltd has significantly strengthened its capital base and diversified its loan portfolio. The Q4 report suggests that digital banking initiatives and expanded rural banking penetration have further fuelled customer acquisition and revenue growth.

The bank’s revenue from treasury operations and fee-based income also showed encouraging growth. The quarterly earnings report positions HDFC Bank favorably for continued expansion in FY25.

HDFC Bank Net Profit April 2024

The HDFC Bank net profit April 2024 figure is not just a number; it represents investor confidence and the bank’s strategic foresight. Despite a challenging economic backdrop, the bank has achieved a profit surge that has reassured shareholders and industry watchers alike.

April 2024 marks the transition into a new fiscal year, and HDFC Bank’s performance has set a positive tone for the sector. With diversified income streams and better cost-to-income ratios, the bank’s profitability is expected to remain strong in the upcoming quarters.

The April results will also be closely monitored by stakeholders looking to gauge how India’s leading bank manages inflation, policy changes, and global economic challenges. To better understand the macroeconomic factors affecting banking profits, read Inflation vs Deflation Explained.

Read More

The HDFC Bank share market impact post-results has been largely positive. Share prices surged over 3% in intraday trading following the earnings announcement, reflecting strong investor sentiment.

Market analysts have adjusted their target price for HDFC Bank upwards, citing robust asset quality and growth in the loan book. The positive sentiment was echoed across the banking index, with Bank Nifty gaining significantly.

However, it’s important to monitor geopolitical influences and currency fluctuations. For example, read De-Dollarization: BRICS Threatens USD 2025 to understand potential external economic pressures.

HDFC Bank Financial Performance Q4 FY24

The HDFC Bank financial performance Q4 FY24 underlines the bank’s operational strength and adaptability. Strong earnings, a healthy balance sheet, and strategic focus have made this quarter one of the bank’s most impactful yet.

Key operational metrics such as Return on Assets (ROA), Return on Equity (ROE), and Capital Adequacy Ratio (CAR) continue to meet or exceed regulatory benchmarks. With sustained demand in retail loans and home finance, the bank is likely to see upward trends in future quarters as well.

Strategically, the bank plans to enhance its technological stack and invest in fintech collaborations to optimize customer service and backend operations.

You may want to know

1. How does the HDFC Bank quarterly earnings report affect investors?

The HDFC Bank quarterly earnings report provides valuable insight for investors. It shows a balanced growth model, good risk management, and strong returns on equity. Investors are more likely to hold or buy HDFC Bank shares, anticipating further upside potential based on performance metrics, cost control, and merger benefits with HDFC Ltd. It also reassures them of long-term capital gains.

2. What is the market’s reaction to HDFC Bank share market impact after Q4 FY24?

The HDFC Bank share market impact post-Q4 earnings has been mostly bullish. Investors reacted positively to the earnings beat, leading to a sharp rise in the stock price. Brokerages have revised their target prices upward. Institutional buyers and mutual funds have increased their stake, showing high confidence in the bank’s long-term prospects.

Final Takeaway

The HDFC Bank Q4 Results 2024 clearly reflect the bank’s operational strength and financial resilience. From a strong net profit to an impressive asset quality ratio, every indicator points to solid growth. Investors, regulators, and industry watchers can draw confidence from this performance.

As India’s banking sector evolves, HDFC Bank is not just keeping pace — it’s leading the way. These results set a strong benchmark for FY25 and provide a sense of stability in a rapidly changing financial ecosystem.

- Net profit of Rs 17,616 crore in Q4 FY24

- 6.9% YoY growth in profits

- Gross NPA maintained at 1.24%

- Total income up 18.3% YoY

- Share price gained 3% post results

- Loan book expansion observed

- Increased digital banking adoption

- Merged operations with HDFC Ltd enhanced portfolio

- Strong operational and risk metrics

- Analysts revise growth forecasts positively

Sources & Relevance

- Moneycontrol – HDFC Bank Q4 Results – This source confirms all the key data points including net profit, income growth, and NPA levels.

🌍 For more update on Financial Domain, Bookmark the Nation Light And if you found this helpful, share it with someone who needs.

Drop your thoughts in the comments below!

Follow us on social media for more updates:

📢📢 Unlock Your Online Potential with Hostinger!

Struggling with Social Media addiction? To know about The Dark Side of Social Media 👉 Click Here

💻 Turn your screen time into income by creating a money-making website! With Hostinger’s affordable hosting, you can:

- ✅ Build a blog, e-commerce store, or portfolio in minutes

- ✅ Monetize through ads, affiliate marketing, or digital products

- ✅ Enjoy lightning-fast speed & 99.9% uptime

🎁 Exclusive 20% OFF for our readers:

👉 Hostinger Affiliate Link

Why Hostinger?

- ✔ 1-click WordPress install (perfect for beginners!)

- ✔ 24/7 live chat support

- ✔ Free SSL certificate (secure your site)

🌟 Example Success:

Riya, a former Social Media addict, now earns $750 /month from her self-care blog—built on Hostinger in just 2 days!

Your Turn:

- 1️⃣ Sign up with our link

- 2️⃣ Launch your site (use detox tips as content!)

- 3️⃣ Start earning while helping others break free!

💡 “Your phone is a goldmine—stop scrolling, start selling!”

Affiliate Disclosure: This page contains affiliate links. We may earn a commission at no extra cost to you.

John Davidson Tourette BAFTA 2026: 3 Shocking Outbursts and the

John Davidson Tourette BAFTA 2026 incident: Discover the truth behind the outbursts and the racial slurs that overshadowed the night’s…

Snooki Cervical Cancer Diagnosis: 5 Heartbreaking Truths About Her Brave

Snooki cervical cancer diagnosis: Nicole Polizzi shares her stage 1 journey. Learn the vital health lessons from this Jersey Shore…

Eric Dane Death Cause ALS: 5 Heartbreaking Facts About the

Eric Dane death cause ALS: The beloved Grey’s Anatomy star and Euphoria actor has passed away at 53. Discover the…

Cinema Advertising Trends 2025: 7 Shocking Truths Behind PVR INOX

Cinema advertising trends 2025 reveal how PVR INOX fueled Aamir Khan’s Sitaare Zameen Par success. Urban films are making a…

US Attacks Iran Nuclear Sites: 3 B2 Bombers Obliterate Fordow

US attacks Iran nuclear sites as B2 bombers hit Fordow. Get the latest on US Iran war news, Israel conflict…

Google Passwords Leaked 2025: 16 Billion Credentials Exposed in Massive

Google passwords leaked 2025: A shocking 16 billion credentials were exposed in the latest data breach threatening Apple, Facebook, and…